Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

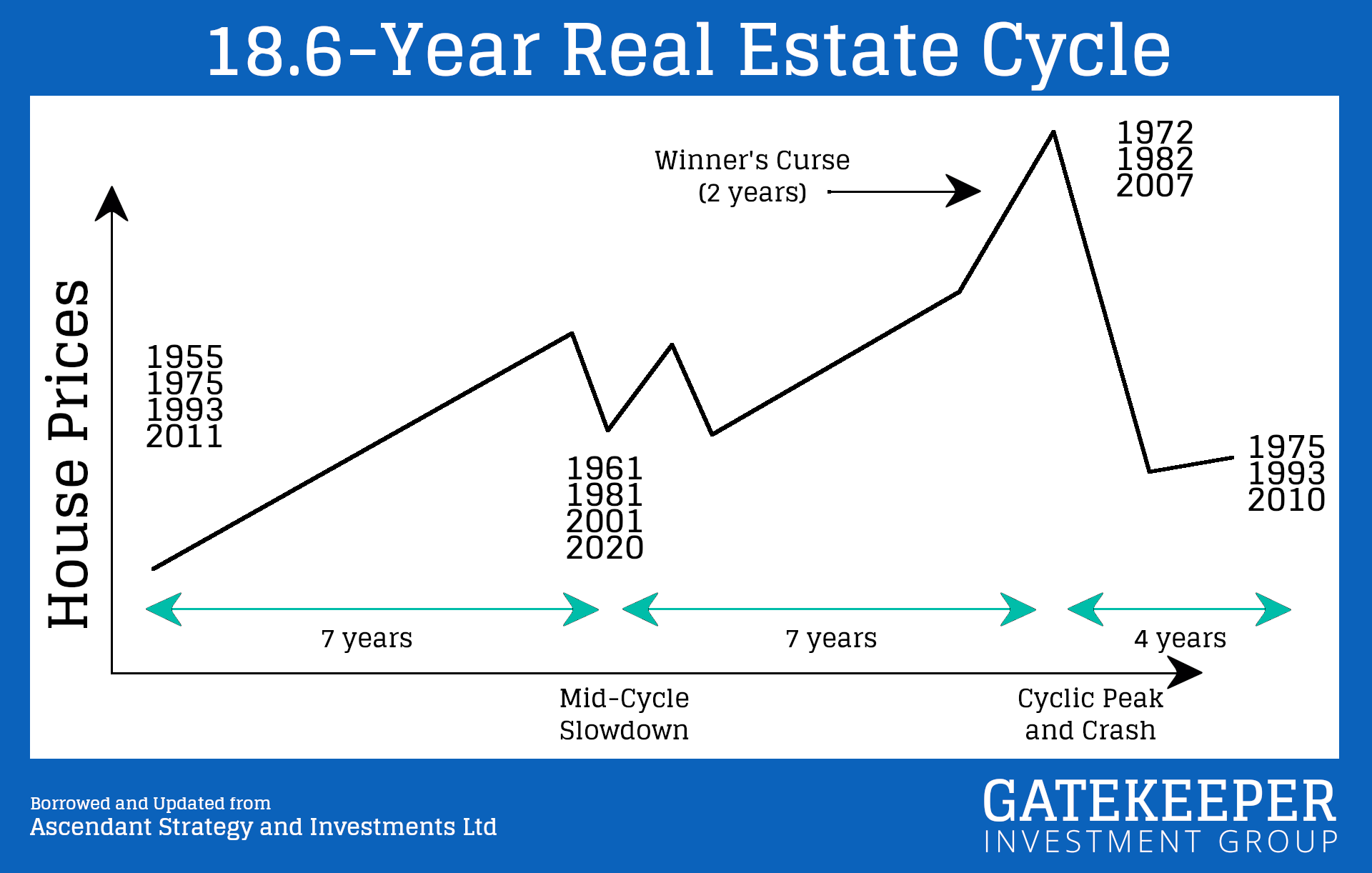

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

The math doesn’t lie. Watch what just 2.7% inflation does to your hard earned money.

/

Gatekeeper Investment Group

What is the most sought-after monopolistic power of man? Answer below.

.

.

.

.

.

.

.

.

.

Printing money at will, from nothing, for nothing./

Gatekeeper Investment Group

Here’s a 90-minute documentary on Bitcoin. Put down the action or romance movie this weekend and watch this instead.

/