Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

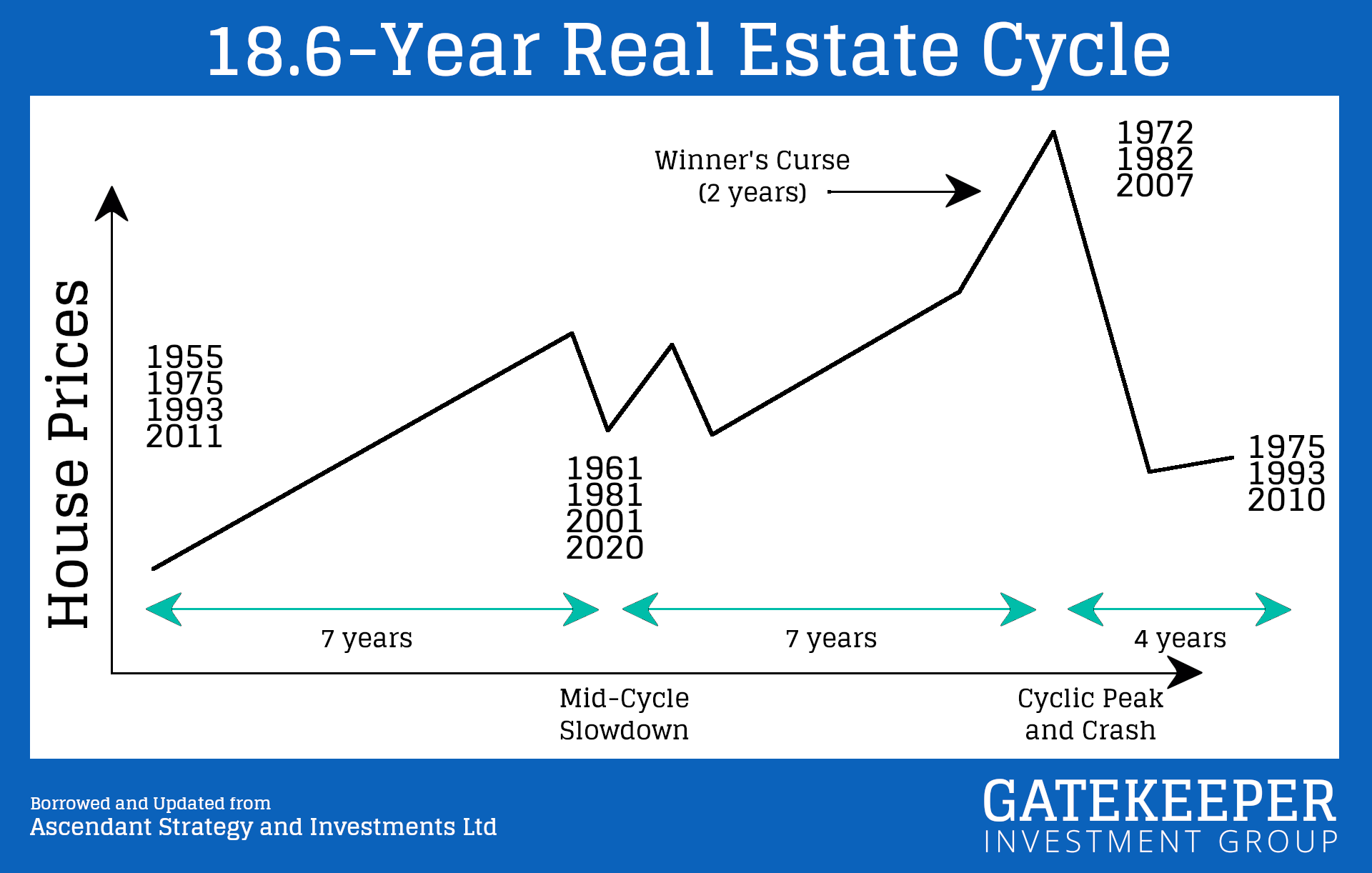

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

I don’t agree with allowing some people to use financial services while restricting others.

Bitcoin allows you to bypass banks and financial firms and go directly to the source.

/

Gatekeeper Investment Group

Ooof. This chart.

God gave you a brain. How are you planning on passing generational wealth to your kids or the church?/

Gatekeeper Investment Group

This is what the end of the 18.6-year Real Estate cycle speculation looks like.

“But with only $12 billion in revenue, the numbers don’t add up, ”

/