Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

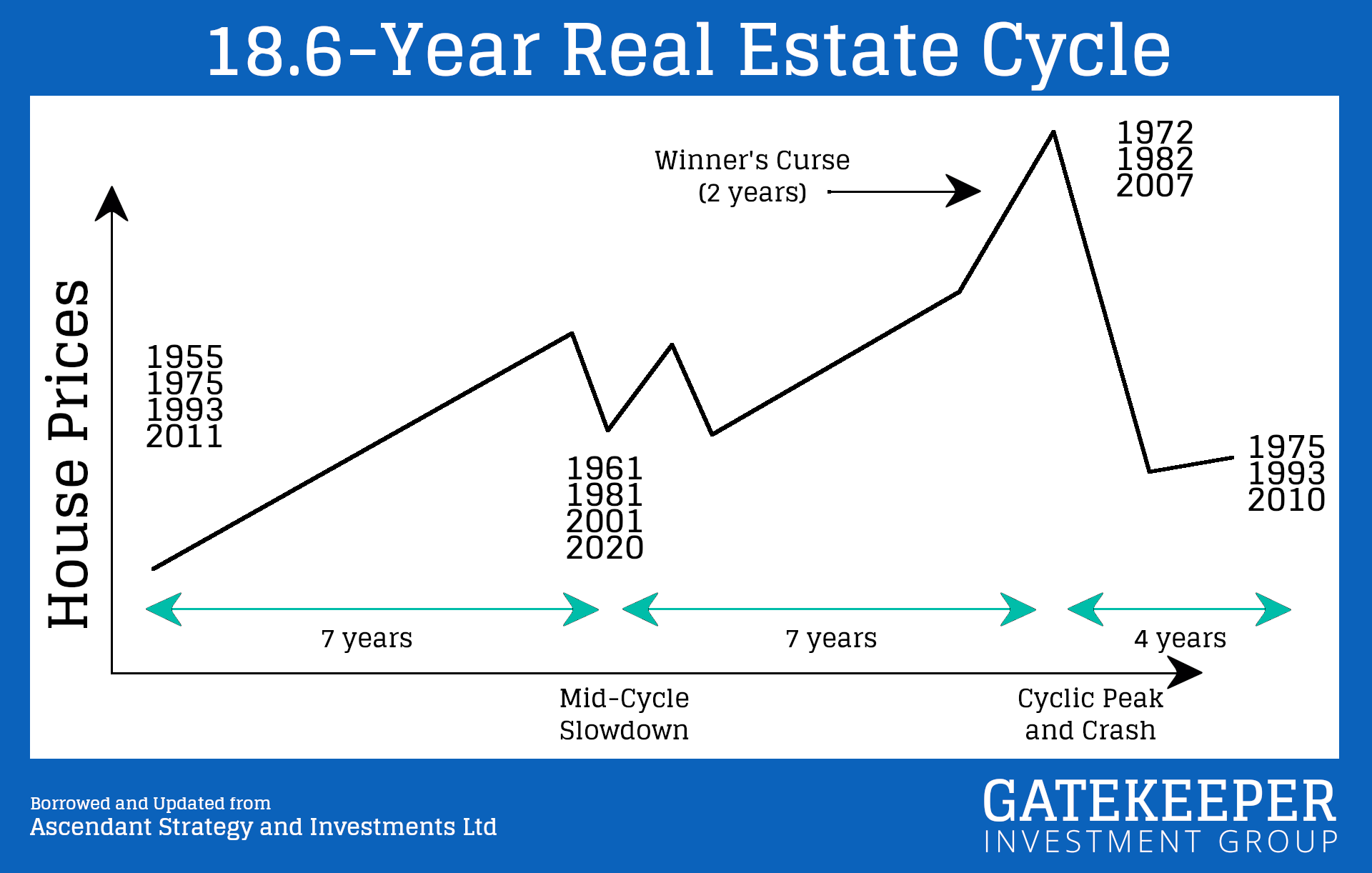

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

The SEC is now giving consumers advice on how to custody digital assets. Probably nothing.

#Bitcoin custody tips now also published by SEC 😉 Keep calm, ignore the noise, and keep stacking sats in self custody. Link in the first comment.

Gatekeeper Investment Group

Let’s see how well this article ages./

Gatekeeper Investment Group

Under large amounts of peer pressure, Vanguard has allowed clients to purchase paper Bitcoin.

Notice I said “paper Bitcoin.” It’s just an IOU. It’s not the real thing. But, if you’re ok with that, go for it. Just remember, not your keys, not your coins.

/

Gatekeeper Investment Group

Such a great explanation of why you should hold Bitcoin and not an ETF./