Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

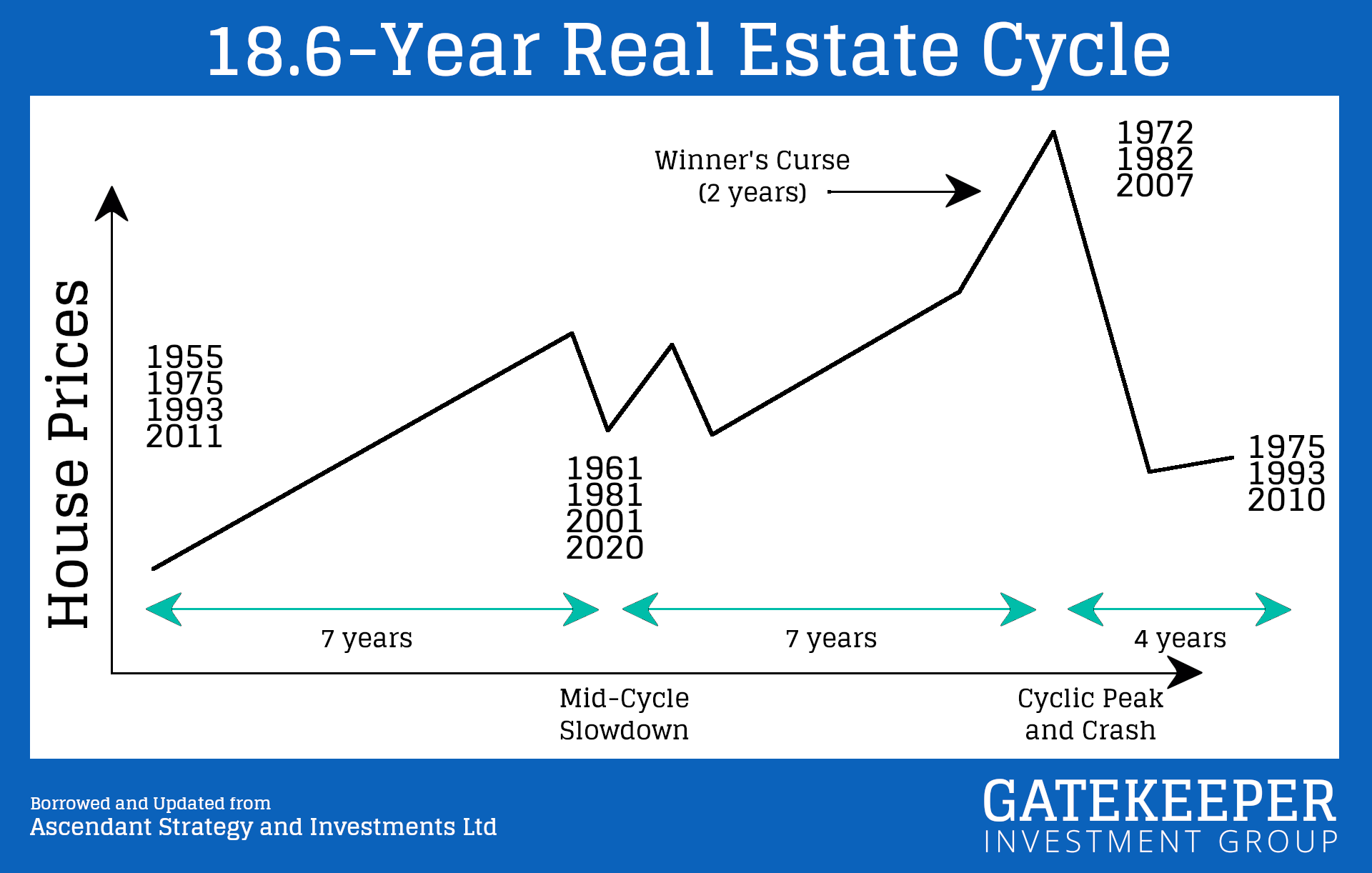

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

Let this page serve as an example of why you should self-custody and not trust a 3rd-party to hold your keys for Bitcoin.

Many exchanges are no longer with us. Some were outright scams, but some left us with sorrow in our hearts. Find them in our Cryptocurrency Exchange Graveyard.

Gatekeeper Investment Group

Where is Bitcoin being mined?

/

Gatekeeper Investment Group

Have you ever watched the Bitcoin process?

/

Gatekeeper Investment Group

What questions do you have regarding Bitcoin?/