Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

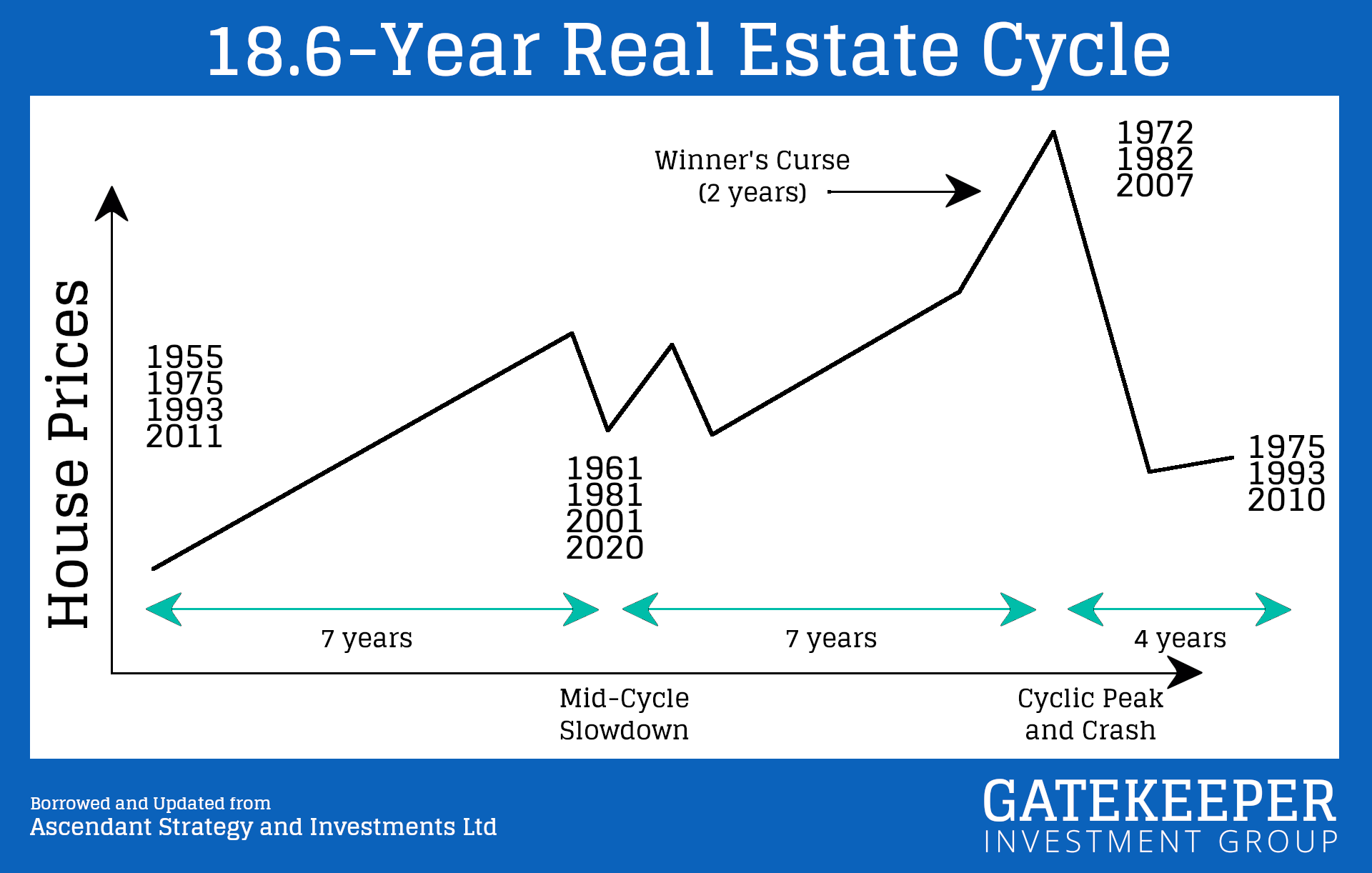

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

Don’t look at all time highs, look at yearly lows.

Something to remember while the world panics 😏

Gatekeeper Investment Group

1971 broke the money./

Gatekeeper Investment Group

Whether you are a Republican or Democrat, both parties spend beyond their means. Inflation continues to eat away at our purchasing power in a system that’s designed to do just that.

We encourage you to study Bitcoin and consider it as an alternative store of value for the long run./

Gatekeeper Investment Group

“Bitcoin is completely transparent, it’s completely distributed, there’s no centralized authority, it can’t be cracked, it can’t be stolen, it doesn’t inflate, it can’t be inflated, it isn’t subject to any form of overt administrative control.” ~ Jordan B Peterson in an interview with John Vallis, Richard James, Gigi, and Robert Breedlove.

It’s a 90-minute video and worth every second. You might think about forgoing the Netflix film tonight and watching this short video on The Future of Money.

After watching the video, if you have an opinion on the matter, let us know what it is.

/