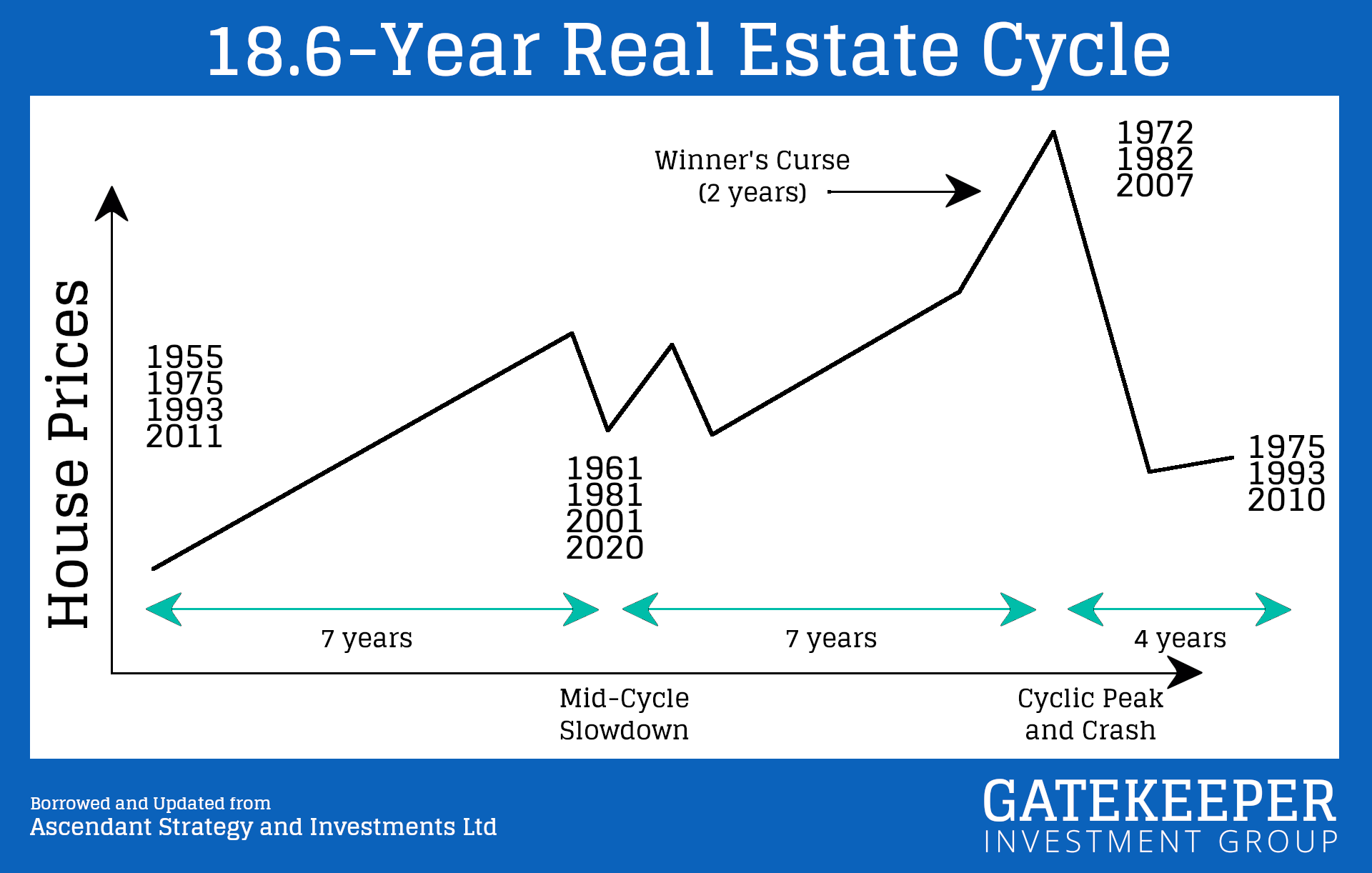

Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

Banks and other financial insitutions have come around to offering Bitcoin services. Do they know something you don’t?

“All the banks… they’ve all flipped their stance in the last six months.” — Michael Saylor BNY Mellon. Citi. JPMorgan. Wells Fargo. Custody, collateral, credit — the entire banking stack is being rebuilt around Bitcoin. If you’re still waiting for the “adoption wave,” this is it. ….

Gatekeeper Investment Group

How are you fighting inflation with your God-given dollars? How are you being responsible and a good steward of what He has given to you?

“Assets aren’t magically becoming more valuable. Instead, fiat is getting devalued.”

I keep pushing myself to read, study, and research more. And this is why.

/

Gatekeeper Investment Group

The S&P500 “growth” is a good measure for inflation./

Gatekeeper Investment Group

123,456 – neat stuff/