Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

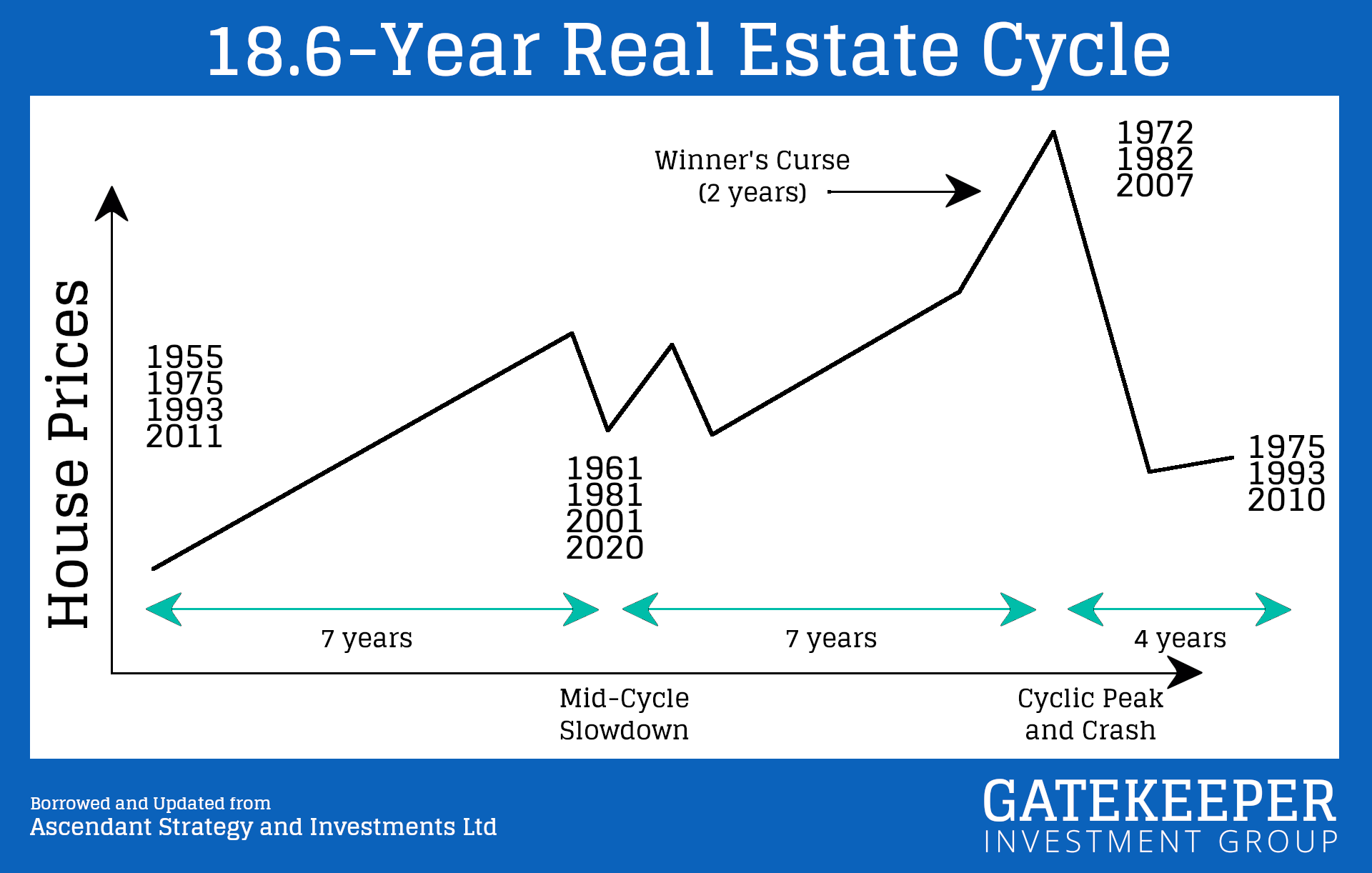

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

Where is Bitcoin being mined?

Bitcoin’s future is shifting to the US as mining becomes cleaner and heavily developed domestically.

Gatekeeper Investment Group

Scam alert.

Bitharvest is a ponzi scheme. Beware.

/

Gatekeeper Investment Group

“This is one of the crazy things about [Bitcoin] because money and speech turned out to be the same thing. Money, information, math; they’re just the same thing.”

“So, in a Bitcoin world, I can literally write down my Bitcoin address and keys on a piece of paper and put it in a safe deposit box, and it’s basically in cold storage.”

“I could even put it in my head and memorize the key phrases, and I could cross [international] borders with a billion dollars in my brain.”

–Nick Szabo on the Tim Ferris podcast 8 years ago.

/

Gatekeeper Investment Group

If you’ve wondered about the 18.6-year global Real Estate cycle but haven’t had the time to research it, this is a concise 8-minute video that explains the cycle in its entirety.

/