Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

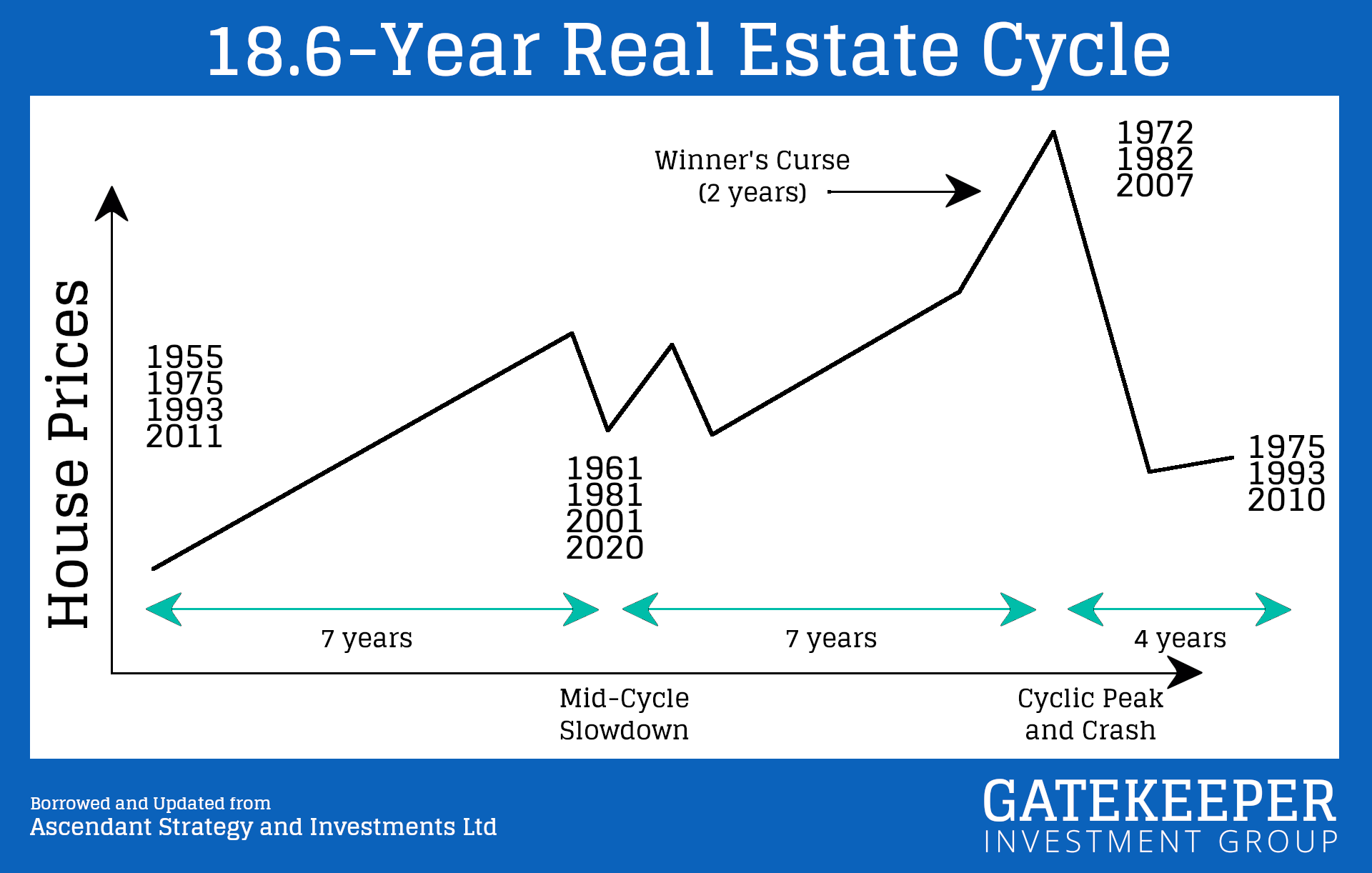

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

Bitcoin explained to a 5-year-old.

If you still can’t figure out what the heck a bitcoin is…

Gatekeeper Investment Group

Bitcoin works for you, not against you, unlike Fiat./

Gatekeeper Investment Group

On October 31, 2008, a nine-page document changed the financial world.

/

Gatekeeper Investment Group

The problem has always been, who maintains the sanctity of the [finance] ledger?

“Can you just forge that ledger? So, historically the central bank would maintain the sanctity of the ledger or the fact that you have a certain dollar bill with a serial number on it maintains the sanctity of the ledger but now Bitcoin has the craziest answer you can imagine, but it turns out to work. Which is everybody has a copy of the ledger. So, everyone on the Bitcoin network who’s running a node keeps a copy of the ledgers from the dawn of Bitcoin until now and there is a testament to the computing power and memory that we have available in modern computers that people can do this at home.” –Nick Szabo on the Tim Ferris podcast 8 years ago

So, what’s the size of the entire Bitcoin ledger?

Bitcoin has been running continuously since 2009, that’s (currently) 16 years, and ALL the transaction data is less than 1TB./