Bitcoin and the 18.6-Year Real Estate Cycle

Our Thoughts

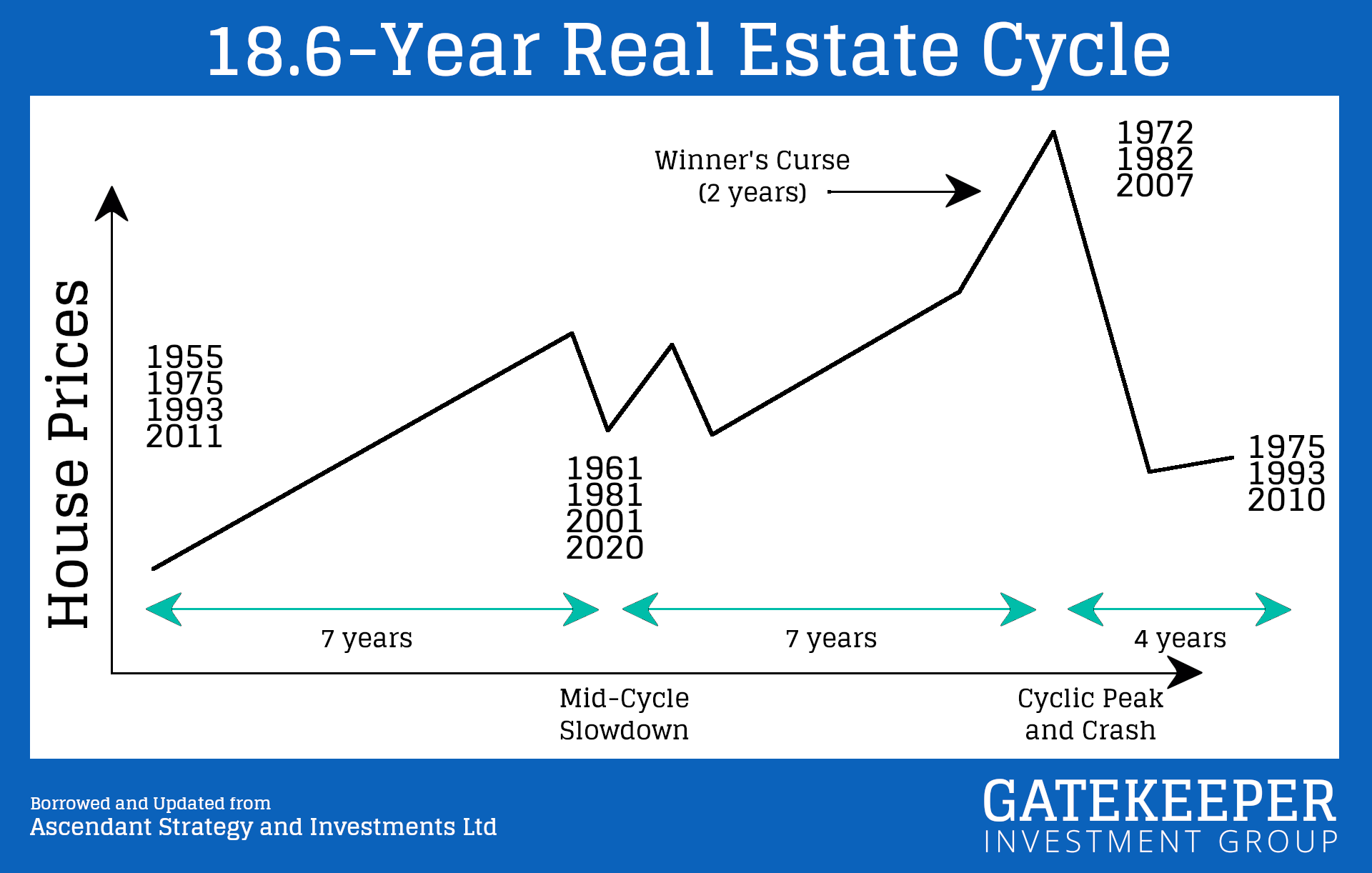

Bitcoin has a 4-year cycle. Real Estate, 18.6.

DYOR. Do Your Own Research.

We got super curious about Bitcoin and the 18.6-year Real Estate cycle in early 2021. Since then we’ve read books and followed others in those spaces, learning all we could about the mysterious “magical” Internet money and the largest asset in the world, land.

Join us in learning more about Bitcoin, the 18.6-year Real Estate cycle, and other financial related topics.

Gatekeeper Investment Group

Here’s a 90-minute documentary on Bitcoin. Put down the action or romance movie this weekend and watch this instead.

God Bless Bitcoin asks the timely question: How do we fix our broken money? Through in-depth conversations with bitcoin and interfaith religious leaders, the…

Gatekeeper Investment Group

I also decided to educate myself on how this Bitcoin technology works.

Have you?/

Gatekeeper Investment Group

Our primary research for trading is based on WD Gann’s work from the early 1900s.

“By the time WD Gann passed away in 1955, he reportedly took over $50,000,000 from the market. In today’s dollars, that is equal to nearly half a billion!” ~TIA Investor/

Gatekeeper Investment Group

For the past 4.5 years, we’ve studied the 18.6-year Real Estate cycle, the history of money, Bitcoin, trading, and other finance topics. We curate posts from educated individuals in their respective sectors.

Here are a few books that are foundational to our research:

18.6-year RE cycle

* The Secret Life of Real Estate and Banking by Phillip J Anderson

* The Secret Wealth Advantage by Akhil Patel

History of Money

* What is Money by Michael Saylor and Robert Breedlove

* Broken Money by Lyn Alden

Trading

* The Truth of the Stock Tape by WD Gann

* Trading in the Zone by Mark Douglas/